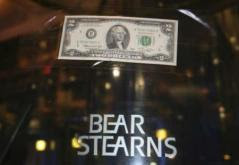

On Sunday evening, JPMorgan announced that it will acquire Bear Stearns for $240 million dollars or at $2 per share. The last trade of Bear Stearns’ stock on Friday on the New York Stock exchange was at $30.85 dollars. With full consideration for its potential costs and risks, JPMorgan has got a good deal. Its stock rose $3.01, or 8.2 percent, to $39.55 at 12:05 p.m. in New York Stock Exchange while the Amex Securities Broker/Dealer Index fell 14 percent today.

I got this news through an internal email at 7:55PM on Sunday. For me as well as the 14,000 fellow Bear Stearns employees, this news was a relief. We now knew that on Monday we would still have a place to go for work. The biggest losers of this fallout will be the equity holders. It is reported that Bear Stearns former CEO James Cayne and British investor Joseph Lewis each lost over $1 billion dollars. Besides institution investors, a big group of investors will be Bear Stearns employees who own up to 30 percent of the outstanding stocks. One of my colleagues said he had accumulated 4000 shares over his 17 years of careers with Bear Stearns. Now he is facing a double jeopardy of losing both his job and the bulk of his retirement savings. While I do not know what words to use on those ‘Wall Street sharks,’ I know that those rank and file employees do not deserve this punishment. Well, Wall Street does not believe in tears.

Nowadays, the world financial markets have developed into a tightly intertwined web. Once this web shows sign of fatigue, the government does not have much time to wait before intervening. Bear Stearns was a weak link. For Fed to let this one wound bring havoc to the entire financial market was not an option. If a $30 billion loan guarantee and a merge of JPMorgan and Bear Stearns created a small unfairness for a few, so let it be. Preventing a financial market meltdown from bringing down the whole economy was an overwhelming goal.

How did we get to this situation? Within Bear Stearns, many people blade former CEO James Cayne for his laid back management style. I agree. On the macroeconomic level however, I believe, we have to blame the formal Fed Chairman Alan Greenspan. After a meltdown of the internet bubble around year 2000, Greenspan kept interest rate low to stimulate the economy. While it was correct and effective to use monetary policy, Greenspan over did it. If Greenspan were a doctor, he kept his patient on blood transfusion too long. A patient who had developed dependency on external help would never stand up on himself. That patient was the economy under Greenspan. After becoming the new Fed Chairman in February 2006, Ben Bernanke attempted to use monetary policy to fight inflation. As soon as Bernanke raised interest rate, the housing market started to dive. The monetary policy had been abused in such that it could no longer be used for its textbook purpose.

Another reason for today’s meltdown lies in the technicality of today’s complex mortgage business model which has developed in such that originators, package makers, issuers and mortgage paper owners are separated. Given low cost of funding (remember Greeenspan?), the mortgage originators had all the incentives to lend. They did the lending as much and as fast as they could. Don’t you forget we are still a capitalist society? What if a loan would go bad and affect the mortgage owners, the originators could not care less. Stories have come out the mortgage lenders colluded with borrowers cheating on the paper work to get the loans approved. Because the mortgage business process was complicated, many of the mortgage owners knew less of what they should have known about those loan packages . Once they started to smell bad and started opening some of the boxes to look inside, bad news came out. As boxes after boxes of bad loans got exposed, we got to where we are.

P.S. The latest news on wire says that JPMorgan plans to cut half of the current Bear Stearns headcounts. Well, all I can do now is to hope that I can survive this cut. I would also like to offer my prayers to evey fellow Bear Stearns employees. For tonight, I wish we all sleep well. Tomorrow is another day.

No comments:

Post a Comment